Energy-efficient home upgrades can cut electric bills, help the environment, and may qualify you for a tax credit. Use IRS Form 5695 to calculate and claim any residential energy-efficient property credits up to 30% or $3,200. First, determine what appliances qualify for the Energy Tax Credit to learn the exact rebate amount.

Aside from appliances, the Inflation Reduction Act makes you eligible for rebates on using alternative energy sources like solar generators. Some Jackery Solar Generator models provide tax rebates of up to $1,500. Besides, its highly efficient batteries can power most heavy-duty appliances during peak hours and power outages.

Key Takeaways

- IRS Form 5695 allows users to determine and claim their appliance tax credits.

- Under the Inflation Reduction Act, homeowners can earn a tax rebate of up to $3,200, depending on the type of appliances they use.

- To determine if your appliances qualify for a tax credit in 2025, check the Energy Star label or access the Energy Star Product Finder.

- Most tax rebates apply to heating and cooling appliances, such as air-source heat pumps, heat pump water heaters, and air conditioners.

Why Does IRS Form 5695 Matter for Appliance Tax Credits?

IRS Form 5695 allows residents to calculate and claim their residential energy credits. It can also help them understand which energy-efficient appliances maximize their energy tax benefits. The credits obtainable with IRS Form 5695 are:

- Residential Clean Energy Credit, previously known as Residential Energy Efficient Property Credit.

- Energy Efficient Home Improvement Credit.

Tax Credit Rules Under the Inflation Reduction Act [2025 Update]

The Inflation Reduction Act is a federal spending bill directed towards reducing inflation, lowering carbon emissions, and combating climate change. Imposed in 2022, the bill saw several changes over the years, and the following are the latest tax credit rules for energy-efficient appliances:

High-Efficiency Electric Home Rebate Program: Under the Inflation Reduction Act section 50122, this program assists low-to-medium-income families in saving money on installing energy-efficient appliances. The maximum obtainable rebate for a single home is $14,000.

Home Efficiency Rebates (HOMES) Program: According to Energy.gov, section 50121 of the IRA incentivizes homeowners to make energy-efficient home upgrades. The higher the savings, the bigger the incentives.

Energy-Efficient Home Improvement Tax Credit: Section 25C of the Inflation Reduction Act provides homeowners a tax credit of up to $3,200 upon making energy-efficient upgrades. The credit covers multiple home upgrades but primarily focuses on heating and cooling appliances.

Residential Clean Energy Credit: The tax credit under the rule equals 30% of the costs of qualified energy-efficient upgrades for your home installed between 2022 and 2032. The percentage phases out to 26% and 22% for upgrades made in 2033 and 2034, respectively.

Clean Electricity Investment Credit: This replaces the Energy Investment Tax Credit and applies to taxpayers with a qualified facility and energy storage technology placed into service after December 31, 2024. The base amount is 6% of the investment, which can increase to 10 percentage points upon meeting certain requirements.

What Appliances Qualify for the Energy Tax Credit in 2025?

Primarily, Energy Star-rated appliances are eligible for the tax credit in 2025. However, check IRS guidelines to determine precisely what appliances qualify for the Energy Tax Credit if considering a home upgrade. This could help you save a lot in taxes.

How to Check If Your Appliance Qualifies for Energy Tax Credit

The primary ways to check what appliances qualify for the Energy Tax Credit are as follows:

- Check for the Energy Star label on your electrical appliance. These products have superior energy efficiency and are eligible for tax credits. You can also use Energy Star Product Finder to find Energy Star-certified products, details, and retailers near you.

- The Department of Energy details the appliances that qualify for tax credits, including air conditioners, heaters, heat pumps, and hot water boilers.

What ENERGY STAR Appliances Qualify for the Energy Tax Credit?

Many Energy Star appliances qualify for the Energy Tax Credit, but the maximum credit applies to heating and cooling appliances. Examples include air-source heat pumps, heat pump water heaters, and air conditioners. Here’s a more detailed breakdown:

Heat Pump Technology

- Air Source Heat Pumps

- Heat Pump Water Heaters

- Biomass Stoves of Boilers

- Geothermal Heat Pumps

Energy Efficient Home Improvements

- Water Heaters

- Furnaces

- Central Air Conditioners

- Boilers

Other

- Electric Vehicle Chargers

- Commercial Dishwashers

- Commercial Cooktops

- Pool Pumps

Now, the question is, what kitchen appliances qualify for the Energy Tax Credit? Refrigerators and dishwashers are eligible, especially if they are Energy Star certified and meet the energy-efficient home improvement credit.

Do Solar-Powered Appliances Qualify for the Federal Tax Credit?

If you invest in renewable energy-run appliances at your property, you might be eligible for a tax credit under the Solar Energy Systems Tax Credit. This can amount to up to 30% of the property in service between 2021 and 2033. The credit percentage drops to 26% in 2032 and 22% in 2033.

Solar water heaters and solar panels are eligible for the rebate. Meanwhile, some Jackery Solar Generator models are eligible for up to a 30% tax rebate.

Appliances That Do Not Qualify for Energy Tax Credit

Some Energy Star appliances, like dishwashers and water heaters, don’t qualify for the Energy Tax Credit. It’s thereby crucial to check the specific criteria set by the IRS. Certain kitchen appliances, like microwave ovens and stoves, also don’t qualify for a tax rebate. This is because their energy consumption is already low, and the difference between new models is less significant.

Step-by-Step: How to Apply for Appliance Tax Credit Using IRS Form 5695

IRS Form 5695 is the paperwork a homeowner must fill out to take financial advantage of going energy-efficient. Follow the instructions in order and obtain credits:

Step 1: Enter Personal Information

Download IRS Form 5695 from the official IRS website or obtain it from a tax professional. Then, fill the top section with your name and Social Security Number. Then, keep the manufacturer's receipts close to input the gross investments in the preceding sections.

Step 2: Residential Clean Energy Credit (Part I)

In this section (Line 1-5) of IRS Form 5695, fill in the cost of your home upgrades. This includes appliances that qualify for tax credits and fuel cells like solar panels and small wind turbines. Add the total home upgrade costs and put them in Line 6.

Step 3: Energy Efficient Home Improvement Credit (Part II)

Here, input the energy-efficient improvements made in your primary home during 2024. This includes any insulation material, air sealing material, or anything designed to reduce heat loss or gain of a home, exterior windows, and doors.

Then, move on to adding the costs of energy-efficient installations made at home. This includes heat pumps, air conditioners, and water or biomass boilers. For more details on verifying appliances' energy efficiency requirements, see Line 22a, Line 25a, and Line 29a through 29e.

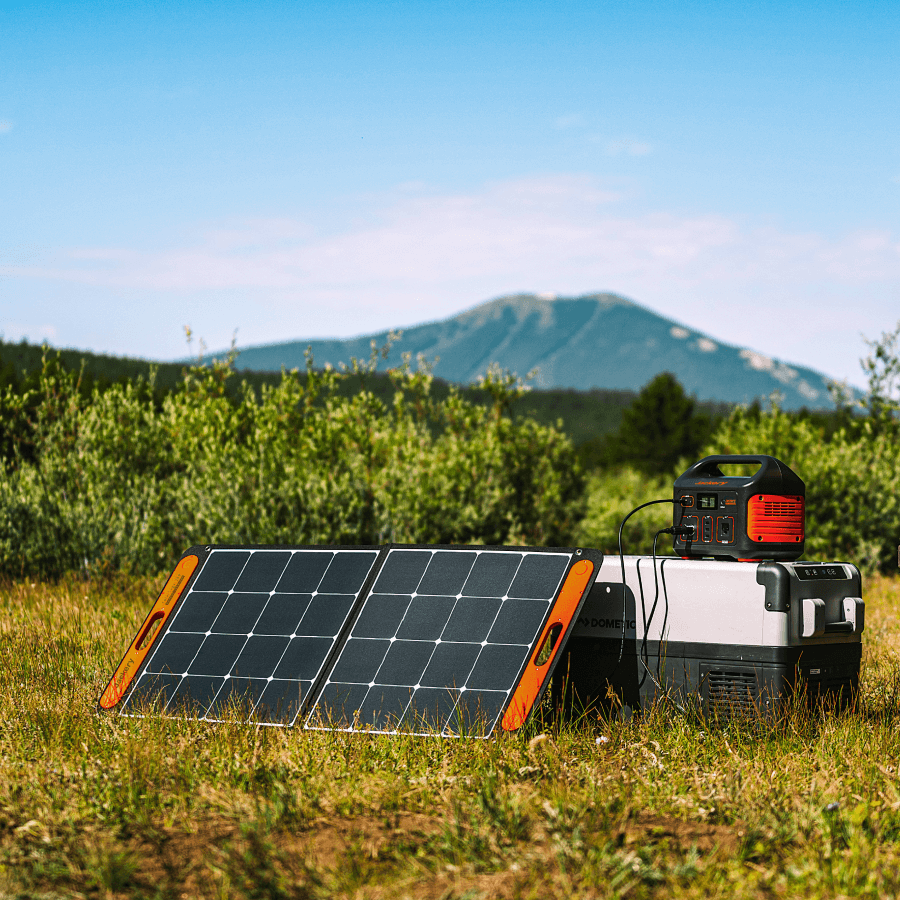

Rebates Available on Jackery Solar Generators

Jackery is a reputable manufacturer of solar-powered generators, portable power stations, and solar panels. The Jackery Solar Generators combine Jackery Portable Power Stations and Jackery SolarSaga Solar Panels to collect, convert, and supply usable electricity. This essential home backup solution can power most home appliances for hours.

Some Jackery Solar Generators and Portable Power Stations qualify for the Residential Clean Energy Credit. Depending on the model, the solar tax rebates range from $839.7 to $1,589.7.

Jackery Solar Generator 5000 Plus

The Jackery Solar Generator 5000 Plus is a reliable and essential home backup solution that can power most indoor and outdoor appliances for hours. It features a pull rod and double wheels for easy transportation during a rolling blackout or extended power outage. With it, you can save up to $1049.7 as a tax rebate, reducing the effective cost of the solar generator.

Appliance Working Time:

- Water Heater (2000W) = 2.1H

- Drill Machine (1000W) = 4.1H

- Gas Furnace (3000W) = 1.4H

- Refrigerator (1500W) = 1.8H

- Central Air Conditioner (2500W) = 1.7H

Customer Review:

“I received the Explorer 5000 Plus solar generator to run my home if power goes out. It works great and will run my whole home if power goes out.”- Dennis Carlson.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is a sizeable battery backup solution for large apartments and households. It can charge small appliances like mobile phones and laptops and heavy-duty appliances like air conditioners and heaters. Investing in this solar generator also qualifies you for up to $1,139.7 in rebates. Whether you want to reduce your electric bills or prepare for a long-term power outage, this can be an essential home backup solution.

Appliance Working Time:

- Water Heater (2000W) = 1.7H

- Gas Furnace (3000W) = 1.1H

- Central Air Conditioner (2500W) = 1.4H

- Refrigerator (1200W) = 2.8H

- Electric Heater (1800W) = 1.9H

Customer Review:

“Perfect for my purpose, which is to supply an oxygen generator.”- Janet.

FAQs

Are renters eligible to claim the Energy Tax Credit on appliances?

No, energy tax credits only apply to improvements made by homeowners to their primary homes in the United States. Renters are not entitled to the credit.

Is there a tax credit for energy-efficient appliances for the Federal?

Yes, there is a federal tax credit for energy-efficient appliances. It’s called the Residential Energy Credit and allows taxpayers to claim a particular portion of their investments in home improvements.

Do I need to own my house to qualify for the Energy Star tax credits?

Yes, Energy Star Tax credits are eligible for an existing home in the United States. The appliances and systems must be new and not used.

What is the maximum income to qualify for tax credits?

The High-Efficiency Electric Home Rebate Program (HEAR) is only focused on assisting households with low-to-moderate income. They must have an income less than 150% of the area's median.

What is the US Clean Energy Tax Credit?

The US Clean Energy Tax Credit equals 30% of the costs of new and qualified energy-efficient improvements in your existing property between 2022 and 2032.

Final Thoughts

IRS Form 5695 can help determine what appliances qualify for Energy Tax Credits and the maximum amount. To maximize tax credits, ensure you do not provide inaccurate information and include IRS-approved energy-efficient improvements. The federal tax credits also apply to adopting an alternative energy source like Jackery Solar Generators. Some Jackery Solar Generator models help you save up to $1,500 on rebates, making the setup more affordable.

![[2025] What Appliances Qualify for Energy Tax Credit Under IRS Form 5695 [Step-by-Step Guide]](http://www.jackery.com/cdn/shop/articles/what_appliances_qualify_for_energy_tax_credit_1a1afd2c-bad4-4e18-97f1-9459ed49b678.jpg?v=1744598802)

Leave a comment