Solar panel systems in Illinois might look expensive at first glance. However, the state offers many solar incentives that make going solar much more affordable for residents. The rebates and programs can help you save thousands of dollars on solar systems, making them worth the investment. Some of the best Illinois solar incentives include the Illinois Shines Program, the Federal Solar Tax Credit (ITC), and Illinois Local Incentives.

If you are an Illinois resident who wants to invest in renewable energy sources with a limited budget, you may consider Jackery Solar Generators. These powerful home battery-powered generators, like Jackery Solar Generator 3000 Pro and Jackery Solar Generator 2000 Plus Kit (4kWh), can charge most household appliances for long hours. Additionally, you can earn up to $839.7 - $1139.7 in rebates.

Illinois Solar Incentives in 2024

The solar market is growing rapidly in Illinois, and the state is encouraging residents and organizations to invest in renewable energy sources with incentives. Illinois state incentives include rebates on excess energy produced and many programs to reduce the initial investment in the solar system. Here's a table that compares different solar incentive programs in Illinois.

|

Illinois Solar Incentives |

What Is It? |

Who Can Claim? |

When Can You Get It? |

How Much Can It Save? |

|

Federal Solar Investment Tax Credit (ITC) |

You earn 30% of your entire solar panel system cost to lower the income tax burden. |

Illinois residents who own their home. |

Only One Time : You earn the rebate when you file the tax after solar panel installation. |

On average, you save $6143 via tax credits in Illinois. |

|

Illinois Shines |

It's a program that pays Illinois residents based on how much the system produces. |

All Illinois residents. |

Ongoing : You earn credits for selling excess power to the utility grid for the first 15 years. |

Varies, but you can expect around $900 - $1000 per year. |

|

Illinois Solar for All |

It's an affordable financing plan for low-income residential customers. |

Income-eligible Illinois residents. |

One Time : It only applies when you purchase the solar panel system. |

Varies depending on the size of the solar panel system installed. |

|

Property Tax Exemption |

Illinois residents get a property tax exemption after installing solar panel systems. |

Illinois residents. |

Ongoing : It affects the property tax rate for the life of the system. |

Varies depending on the solar panel system you have installed and your property tax rate. |

|

Local Incentives |

These are the tax incentives and other rebates offered by the local governments and utility companies. |

Varies depending on the local incentive types. |

It varies by program. |

It varies by program. |

|

Net Metering |

It allows you to earn credits for the overproduction of electricity and offset future utility bills. |

ComEd, MidAmerican, and Ameren utility customers. |

Ongoing : It's always in effect. |

Varies depending on system size, credit rate, and energy needs. |

Federal Solar Tax Credit (ITC)

The Federal Solar Tax Credit (ITC), also called the Renewable Clean Energy Credit, helps Illinois residents deduct a percentage of their total system cost from their federal taxes during the year of installation.

Although the percentage has changed over the years, it will remain at 30% until 2033. That said, if you install a $16000 home solar system, you can claim around $4800 as a valid tax form expense.

Here are some standards you must meet to qualify for this tax credit:

- Only those Illinois residents who own their system can apply. That means you must own the solar panels that are new or are being used for the first time.

- You must be a primary or secondary resident of your home. If you live at rent, the homeowner must qualify to receive federal tax credits.

You can claim these federal solar tax credits by filing the annual federal tax return. If you file taxes yourself, make sure to complete and submit IRS Form 5695 with your federal tax return.

Illinois Shines Program

The Illinois Shines Program supports the state's target of having 40% of its energy come from renewable energy sources like solar by 2030, 50% by 2040, and 100% by 2050. It's an extremely popular program, so there is a waitlist. However, you must work with an approved vendor to qualify for the Illinois Shines Program. They will either reduce the upfront cost of the solar system based on the SERC value or pay after the program makes its payment to the approved vendor.

Here's how the program works: The Illinois residents earn one SREC for every 1000 kWh of energy their solar system produces in the first 15 years of operation. These SRECs can then be sold to the local power companies at the current market rate. One thing to remember is that the block for small solar systems under 25 kW is full for 2023-24, though you can apply to be added to the waitlist. Your ability to sell SERCs and their average value depends on supply and demand.

Illinois Solar for All Program (ILSFA)

The Illinois Solar for All Program is an alternative to the Illinois Shines Program that makes solar more accessible to homeowners with lower incomes. The Illinois residents who own a single-family home have an income of 80% or less of the Area Median Income (AMI). The monthly costs or fees of the solar system will be less than half the value you will receive from the energy it produces.

For instance, if the solar system produces $100 worth of electricity, you won't owe over $50 to your solar company. Similar to the Illinois Shines Program, you need to work with an approved vendor to participate in this program. There are three main financing options available.

For example, you can either take out a solar loan to purchase the system or lease a system where the payments will be less than half the value of electricity generated. Overall, this program is an excellent financing program for nonprofits and low-income households that lets you install solar with no upfront expenses.

Illinois Property Tax Exemption

When you install solar systems on your residential property, it increases the overall value of your home. However, you don't have to worry about increased property taxes.

The state of Illinois waives the taxes on additional home value from solar systems. That means your property tax will remain the same before and after the installation. You can ask for a property tax adjustment.

The tax assessor will calculate the property value as the lesser of whether the home had conventional heating and cooling systems or solar systems. It's a common perk in the US that helps you save thousands over the entire life of the system.

Illinois Local Incentives

There are many local-level savings available in different cities of Illinois. Although they do not offer the same level of savings as federal and state incentives, that does not mean they are not worth considering.

City of Chicago Green Building Permit : The City of Chicago administers these incentives, which are generally available to Illinois residents. The program reduces the cost of permits and grants qualifying solar projects. The Solar Express Program is part of the Green Building Program and speeds up the permitting process for solar panel installations in Chicago.

Small Business Improvement Fund : Unlike other Illinois solar incentives, this program provides incentives for small businesses. It uses funds from TIF (Tax Increment Financing) and is only available in TIF districts. It mainly covers the 30%, 60%, or 90% of the solar installation cost based on the business size.

ComEd Commercial Solar Rebate : Commonwealth Edison, one of the largest utility companies, offers solar rebates for residential and commercial customers. If you are a ComEd customer and want to install solar panels on the commercial property, you are eligible to receive $250 per kilowatt (kW) of the installed power. However, solar systems must be under 2000 kW to qualify.

Smart Inverter or Distributed Generation Rebate : As an Ameren or ComEd customer, you get an upfront rebate for installing a solar panel system or battery storage system with a smart inverter. You will earn $300 for one kW of solar or kilowatt-hour of energy storage you install. For example, you will earn $1500 for a 5 kW solar panel system or $4500 for a solar panel system and a 10 kW battery.

Large Distributed Generation (DG) Category of Illinois Shines : The program offers financial incentives to large businesses for ground-mounted solar arrays or onsite rooftops at prices of $30 - 50 per megawatt hour generated. The size of the solar system should be under 5 MW.

Community Solar Subscription through Illinois Shines : With this incentive program, large businesses can earn credits on their monthly electricity bills for the solar energy produced by their subscription size. The maximum subscription size is around 40% of community solar projects.

Illinois Net Metering

Net metering, also called net energy metering (NEM), is a policy that allows you to sell the excess power or energy generated by the panels back to the electricity grid for credit. The compensation is based on the retail electricity rate or the price you pay for electricity supply. Every kWh your solar system produces will gain enough credit to offset the cost of one kWh.

With a net metering program, you can sell excess generated energy back to the utility grid when the solar panels produce more power than you need or use the credit when the system underproduces, like overnight or on cloudy days. The solar installers typically handle this. They start by checking if you have a bidirectional meter installed.

The utility company will then check the solar system to ensure it meets the requirements for connecting it to the grid. Once you are qualified, the utility company will offer you PTO (permission to operate).

Are There Solar Incentives Scams in Illinois?

With more Illinois residents switching to solar energy, there are many solar incentive scams that are prevailing in the market. Here, we will include the common types of solar scams you must look for:

Fake Incentives : It's one of the common types of solar scams that involves the scammer asking you to pay them an amount to enroll in a non-existent solar incentive program. The best defense against these fake incentives is to educate yourself about the real solar incentives in Illinois. Researching the incentives on Illinois government websites or other reputable sources is recommended.

Overcharging for Products and Services : The average cost of a 7.5 kW solar system in Illinois is around $20,000 - $21,000 before applying for incentives. If you get a quote for a similar-sized solar system at a much higher price, you should carefully check the details from different companies. Remember, the prices might vary by location. So, make sure to get several quotes and compare them to choose the best one.

Stretched Truth Scams : There are many scams that misinterpret solar incentives to make it seem like you are getting a better deal. It could be misinterpreting the federal ITC as a tax rebate. There are some companies that include the ITC in the cost of their systems to make it seem like they are 30% cheaper. One way to avoid this scam is to ask for a detailed cost breakdown — including installation costs.

Is Solar Worth It in Illinois?

Yes, solar systems are worth the investment in Illinois. The environmental benefits, available incentives, and potential for long-term savings on the monthly electricity bills. Let's explain the benefits of solar system briefly:

Solar Incentives : Illinois provides many solar incentives to encourage the adoption of solar energy by residential and commercial customers. These include grants, tax credits, and rebates. It is highly recommended to always research and understand how these incentives can help you reduce the upfront costs of installing the solar system.

Energy Efficiency : The average electricity bill in Illinois has increased over the last few years. It is essential to consider your monthly electricity bills during installation. For example, if you have high electricity bills, an efficient solar system can help you offset these costs and earn long-term savings on utility bills.

Environmental Benefits : Solar panels and a battery backup system can help you reduce greenhouse gas emissions and dependence on fossil fuels. It is a clean, renewable power source that makes a choice more environmentally sustainable.

The average cost of solar panel system installation in Illinois ranges between $25000 - $26000 or even higher based on the size and type of panels. However, if you want to go for a budget-friendly option, you may consider portable solar generators that combine solar panels and battery backups.

Jackery Solar Generators in Tax Rebates

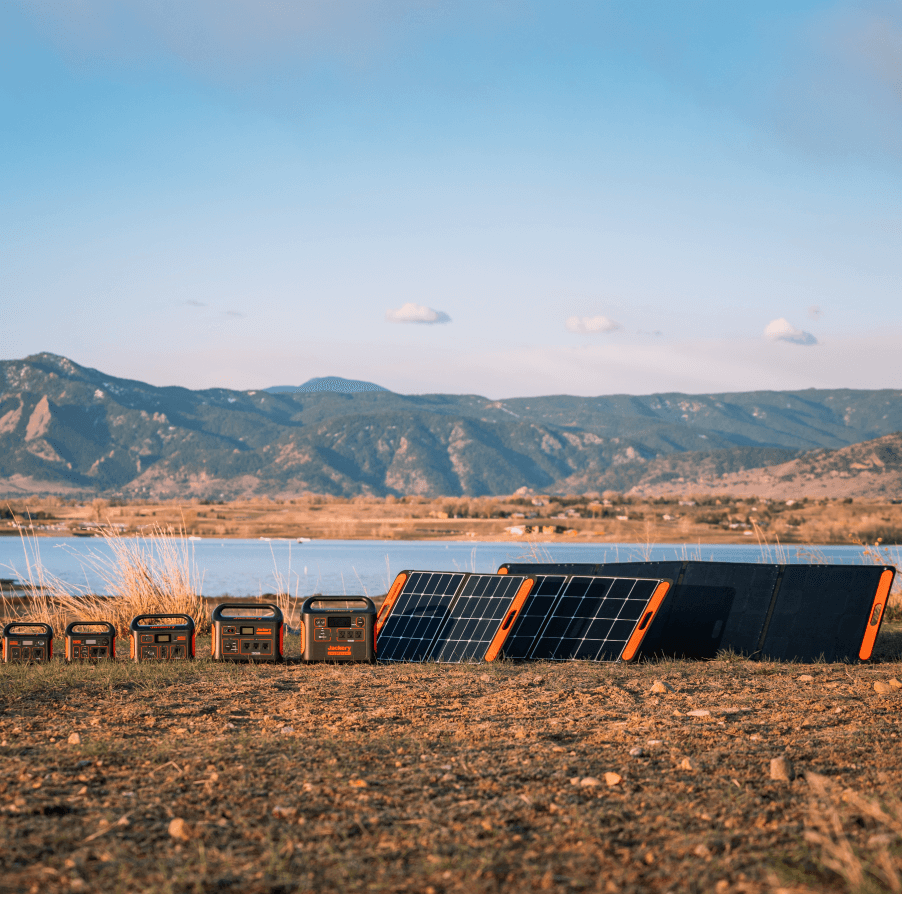

Jackery is a well-known solar brand that manufactures and sells high-quality solar generators, power stations, and solar panels. The Jackery Solar Generators combine portable Jackery Explorer Portable Power Stations and foldable Jackery SolarSaga Solar Panels to collect solar energy, convert the DC to AC electricity, and supply electricity to household or outdoor appliances.

If you purchase Jackery Solar Generators, you may qualify for an annual residential clean energy tax credit. The tax rebate is typically around 30% of the costs of new and qualified clean energy property for homes installed between 2022 and 2032. You can claim the credits if you own a home in the United States. If you qualify, file Form 5695, Residential Energy Credits, with your tax return.

Jackery Solar Generator 3000 Pro

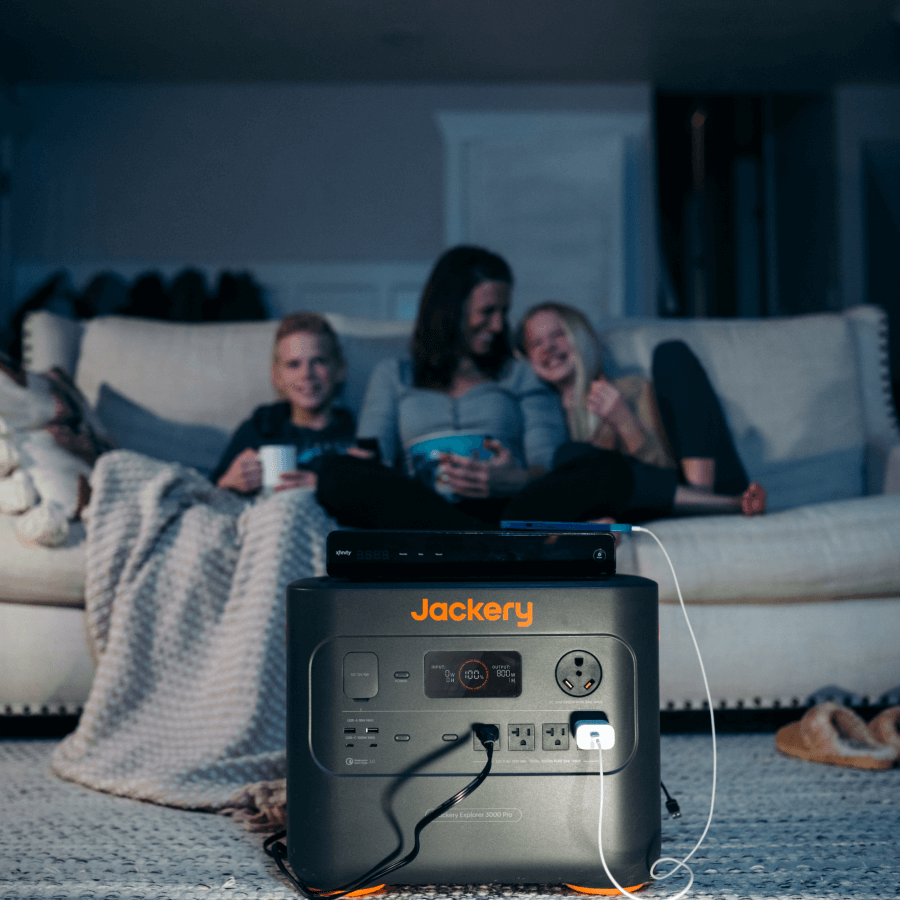

The Jackery Solar Generator 3000 Pro is a sizeable battery-powered generator that can charge up to 99% of household appliances, such as refrigerators, air conditioners, space heaters, LED lights, TVs, and coolers. If you invest in this large home battery backup, you will earn $839.7 in tax rebates to lower the overall cost of the solar generator. Additionally, these portable solar generators are low-cost compared to rooftop solar panel systems, making them more affordable.

Customer Review

“We use this for the basics: fridge, 3 lights in the living room, and a light in our kitchen. In addition to charging various devices. It gets the job done.” — Michelle H.

Jackery Solar Generator 2000 Plus Kit (4kWh)

The Jackery Solar Generator 2000 Plus Kit (4kWh) is a large, expandable charging solution for homeowners. It can charge 99% of household appliances for long hours by converting solar energy into usable AC electricity. When you purchase the Jackery Solar Generator 2000 Plus Kit (4kWh), you are entitled to receive $1139.7 in rebates. If you want more power, the battery backup can be expanded up to 24 kWh using the additional Jackery Battery Pack 2000 Plus.

Customer Review

“The Jackery Explorer 2000 Plus and Battery Pack with the solar panels package is a great combination for home backup and RV usage. I like the idea if I need more power in the future I can purchase another battery pack. The wheels on the generator are great as 64 lbs is easier to pull/push instead of carrying it.” — Larry Gee.

|

|

Solar Generator 3000 Pro |

Solar Generator 2000 Plus Kit (4kWh) |

|

Capacity |

3024 Wh |

2-24 kWh |

|

Battery Cell |

NMC |

LiFePO4 |

|

Cycle Life |

2000 cycles to 70%+ capacity |

4000 cycles to 70%+ capacity |

|

Recharging Methods |

Solar Recharging: 3.5 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging: 35 H Wall Recharging: 2.4 H |

Solar Recharging: 2 H (6*Jackery SolarSaga 200W Solar Panels) Car Recharging: 25 H Wall Recharging: 2 H |

|

Output Ports |

AC Output (x1): 120 V~ 60 Hz 25 A Max AC Output (x3): 120 V~ 60 Hz 20 A Maximum USB-C Output (x2): 100 W Maximum, 5 V⎓3 A, 9 V⎓3 A, 12 V⎓3 A, 15 V⎓3 A, 20 V⎓5 A |

AC Output (×4) 120 V~ 60 Hz, 20 A Maximum AC Output (×1) 120 V~ 60 Hz, 25 A Maximum USB-A Output (x2): Quick Charge 3.0, 18 W Maximum USB-C Output (x2): 100 W Maximum, (5 V, 9 V, 12 V, 15 V, 20 V up to 5 A) |

|

Working Hours |

Coffee Maker (1000 W): 2.5 H Air Conditioner (1000 W): 2.5 H Microwave (1050 W): 2.4 H Kettle (850 W): 3 H Electric Oven (800 W): 3.2 H |

Coffee Maker (1000 W): 3.4 H Air Conditioner (1000 W): 3.4 H Microwave (1050 W): 3.3 H Kettle (850 W): 4 H Electric Oven (800 W): 4.3 H |

|

How Much It Can Save with Tax Rebates |

$839.7 (Though this is an estimated value) |

$1139.7 (Though this is an estimated value) |

Illinois Solar Incentives FAQs

Does Illinois offer incentives for solar panels?

Yes, Illinois offers many incentives for installing solar panels and battery storage systems. These include Illinois Solar for All, Illinois Shines, and the City of Chicago Green Building Permit.

How long does it take for solar panels to pay for themselves in Illinois?

On average, it takes nearly 13 years for solar panels to pay for themselves in Illinois. However, it can be influenced by various factors, such as the amount of sunlight received, the current electricity costs, and the tax rebate you get for the chosen solar plan.

How much does it cost to put solar panels on your house in Illinois?

The typical homeowner in Illinois can expect to pay between $12000 and $25000 for their solar panel system. However, the amount will depend on the size of the solar power system, the size and energy efficiency of the household, average electricity usage, typical energy costs, and the federal tax credits.

Does Illinois have a free solar program?

Illinois Solar for All is a state-run free solar program accessible to most income-eligible residents. It mainly offers two programs: Residential Rooftop Solar and Community Solar.

What is the Illinois government program for solar panels?

Illinois Solar for All is a popular state program available to households, public facilities, and nonprofit organizations. With this program, you get affordable solar installations and save on electricity bills. It was created under the Future Energy Jobs Act and implemented by the Illinois Power Agency.

Final Thoughts

Illinois residents can access various state, federal, and local incentives to reduce the overall costs of solar panel installation. You can even earn money from Illinois solar incentive programs like net metering programs. Jackery Solar Generators are available in many sizes and are ideal for homeowners. For example, you can get tax rebates when purchasing the Jackery Solar Generator 3000 Pro and Jackery Solar Generator 2000 Plus Kit (4kWh). They have built-in wheels to move the solar generator from one place to another to charge appliances anytime, anywhere.

Leave a comment